Never pay for covered car repairs again.

Endurance picks up where your auto warranty leaves off. When breakdowns happen, our vehicle protection plans shield you from the high cost of parts and labor.

Get your FREE Quote

Simply fill out the information below and we will follow up fast with your free no-obligation quote.

By clicking the button, you consent to Endurance using automated technology to call, email, and text you using the contact info above, including your wireless number, if provided, regarding auto protection or, in California, mechanical breakdown insurance. You also agree to the Endurance Privacy Policy and Terms and Conditions. Consent is not a condition of purchase, and you can withdraw consent at any time. Message and data rates may apply.

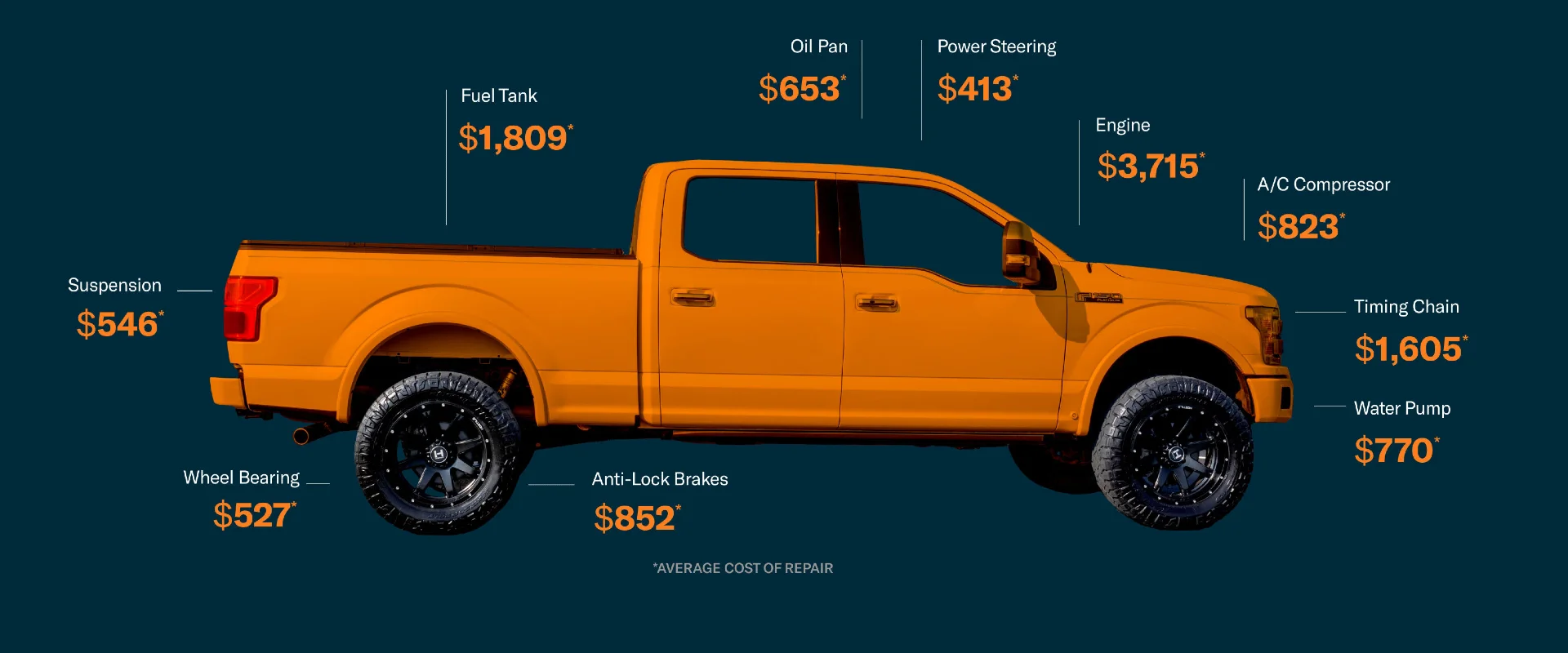

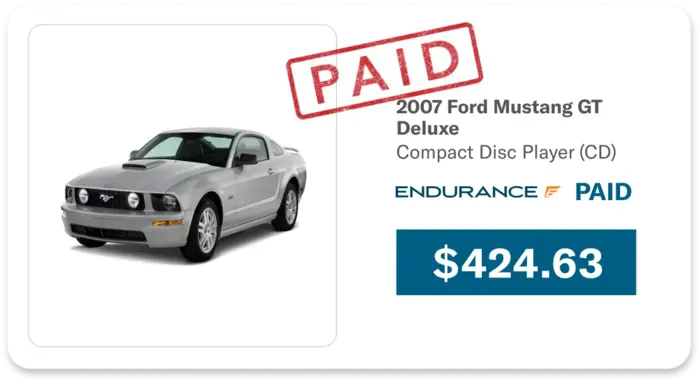

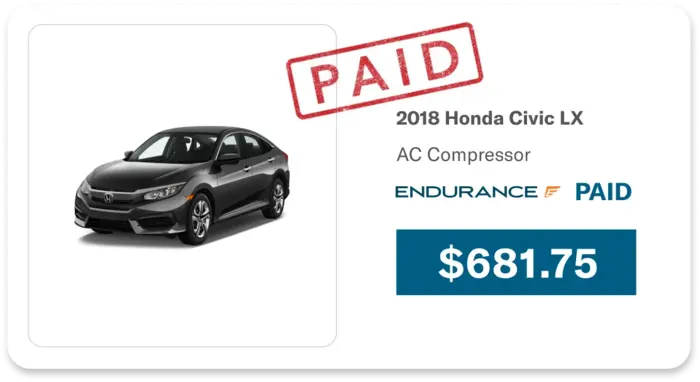

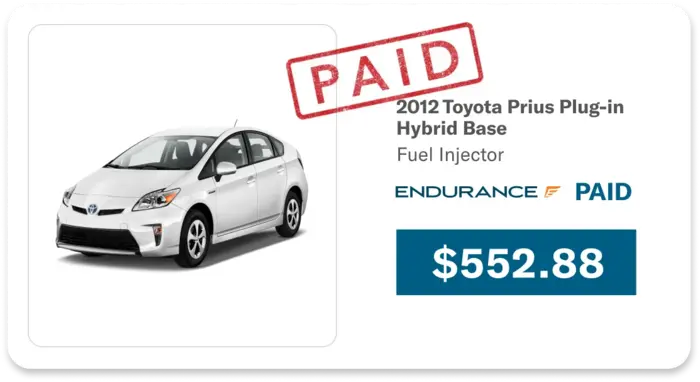

Select a model above and swipe over the car to reveal the average costs of repair per part.

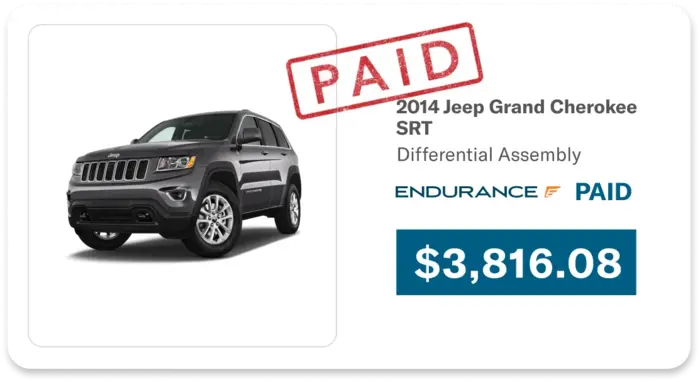

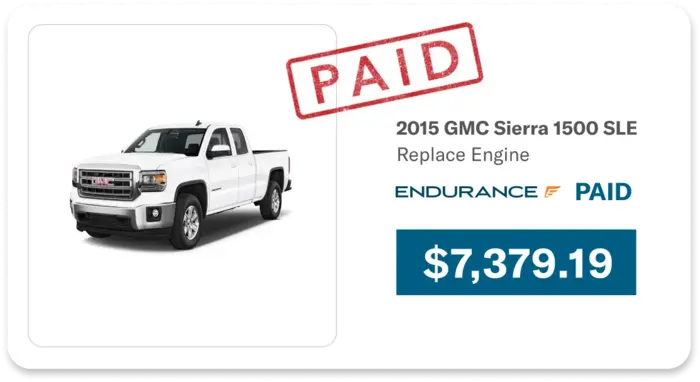

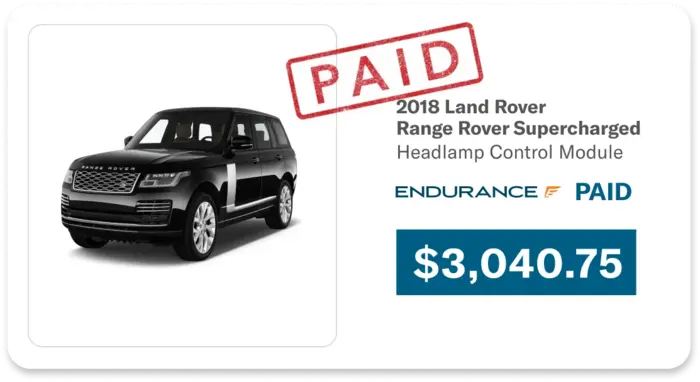

We’ve got your back.

No matter how new or well-maintained your vehicle is, it will eventually need repairs. With Endurance on your side, you can get back on the road fast. Just give us a call and we’ll take care of the rest.

-

30-day money-back

guaranteeTry the best protection at an unbeatable value risk-free for 30 days.

-

You’re in

the driver’s seatChoose any certified mechanic to work on your vehicle.

-

Quick and easy

claimsWe cut out the middlemen to get you the help you need faster.

Through our partnership with RepairPal, gain access to a network of over 3,500 certified auto repair shops and dealerships nationwide. Find a shop.

Benefits that go

above and beyond.

Take advantage of valuable perks like 24/7 roadside assistance when you sign up for any Endurance vehicle protection plan. Best of all, activate your Elite Benefits package, which includes tire repair, key fob replacement and more—FREE for one year.*

Pit crew-approved protection.

Endurance goes the extra mile to give you the protection and savings you deserve.